Yes, police can tell if you don’t have insurance. If you are stopped for a traffic violation and the officer asks for your proof of insurance, you will be required to show it. If you don’t have insurance, the officer will likely issue you a ticket.

If you are stopped by the police for a traffic violation, they may ask to see your proof of insurance. If you don’t have insurance, they may give you a ticket and impound your vehicle.

Police are tracking you and your license plates

Can Police Pull You Over for No Insurance

If you live in the United States, you are required by law to have car insurance. If you don’t have car insurance and you get pulled over, the police officer can give you a ticket for driving without insurance. The penalty for driving without insurance varies from state to state, but it is usually a fine and/or points on your driver’s license.

In some states, the penalty for driving without insurance is much more severe, such as having your driver’s license suspended or revoked. If you are caught driving without insurance and you cause an accident, you could be sued for damages by the other driver(s).

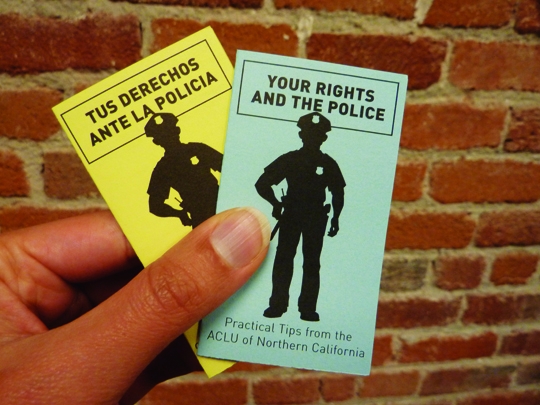

Credit: www.aclunc.org

-No

It is not advisable to keep a pet dog in an apartment.

It is not advisable to keep a pet dog in an apartment for several reasons. First, dogs need exercise and space to run around.

An apartment simply doesn’t provide enough room for a dog to get the exercise it needs. Additionally, dogs need access to a backyard or park where they can relieve themselves. Most apartments do not have this type of access, which can mean having to take your dog out multiple times per day just for potty breaks – something that isn’t always convenient or possible.

Finally, dogs are social creatures and need regular interaction with people and other dogs. Living in an apartment means your dog will likely spend more time alone than if he lived in a house with a yard, which can lead to behavior problems down the road.

The Police Cannot Tell If You Have Insurance Just by Looking at Your Car

This is a common misconception that many people have about the police and insurance. The reality is that the police can tell if you have insurance just by looking at your car. If you have an uninsured vehicle, the police will likely ticket you and impound your vehicle.

So, if you’re ever pulled over by the police, be sure to have your insurance information ready to go.

They Would Need to Run Your License Plate Number Through Their System, Which Would Show Whether Or Not You Have Insurance on File With the Dmv

If you’re caught driving without insurance, you could be subject to a fine or your license could be suspended. So, if you’re wondering whether or not someone has insurance, the best way to find out is to run their license plate number through the DMV system.

-If You are Pulled Over And the Police Officer Suspects That You Do Not Have Insurance, They May Ask You for Proof of Insurance

If you are pulled over by a police officer and they suspect that you do not have insurance, they may ask you to provide proof of insurance. If you cannot produce such proof, the officer may issue a citation or even impound your vehicle. To avoid this situation, it is always best to carry proof of insurance with you whenever you drive.

If You Do Not Have Proof of Insurance, the Officer May Issue You a Ticket Or Summons to Appear in Court

If you are stopped by a police officer and do not have proof of insurance, the officer may issue you a ticket or summons to appear in court. This is because it is illegal to drive without insurance in most states. If you are caught driving without insurance, you may be fined, have your license suspended, or even be arrested.

-If You are Involved in an Accident, the Police Will Likely Request Proof of Insurance from Both Parties Involved

If you are involved in an accident, the police will likely request proof of insurance from both parties involved. If you have car insurance, your insurer will typically send a notice of insurance to the other driver’s insurer. The other driver’s insurer will then pay for damages up to their policy limit.

If One Party Does Not Have Insurance, They May Be Liable for Any Damages Incurred by the Other Party

If you are involved in a car accident and the other driver does not have insurance, you may be wondering who will be responsible for paying for the damages. In most cases, the uninsured driver will be liable for any damages incurred by the other party. This includes damage to your vehicle, medical expenses, and any other costs associated with the accident.

If you have comprehensive or collision coverage on your own insurance policy, you may be able to file a claim with your insurer to receive compensation for your damages.

Conclusion

No, police cannot tell if you have insurance just by looking at your car. There are a few ways that they could find out, such as running your license plate number or asking you for proof of insurance, but they would need to have a reason to believe that you might not be insured before they took those steps.