Imagine you’ve invested in an annuity, and it’s providing you with a steady stream of income. It’s a comforting thought, isn’t it?

But have you ever wondered what happens to that annuity when you pass away? It’s a question that might not immediately cross your mind but is crucial to consider. Understanding the fate of your annuity can bring peace of mind, ensuring that your loved ones are well taken care of.

You’ll discover the various scenarios that can unfold regarding your annuity after your death. You’ll gain insights into how your choices today can shape the financial security of those you care about tomorrow. So, if you’re curious about safeguarding your legacy and ensuring your annuity aligns with your wishes, keep reading. This knowledge is key to making informed decisions that benefit both you and your family.

Credit: canvasannuity.com

Annuity Basics

Annuities can continue paying after your death, depending on the type. Options include payments to beneficiaries or a lump sum. Understanding your contract is essential for knowing how your annuity will be handled.

Annuities are a popular choice for many people planning their retirement. They offer a steady income stream, acting as a financial safety net. But what happens to an annuity when you die? Understanding the basics can help you make informed decisions. Let’s break it down.

What Is An Annuity?

An annuity is a contract between you and an insurance company. You pay a lump sum or make regular payments. In return, you receive regular payouts in the future. It’s like setting up your own paycheck for retirement.

Types Of Annuities

There are various types of annuities, each with unique features. Fixed annuities offer a guaranteed payout. Variable annuities depend on the investment’s performance. Immediate annuities start paying you right away, while deferred ones begin later. Knowing the difference helps you choose what fits your needs.

How Do Annuities Work?

An annuity grows your money over time. The insurance company invests your payments. The growth can be fixed, variable, or indexed. When the payout phase begins, you receive periodic payments. These can last for a set number of years or your lifetime.

Beneficiaries And Death Benefits

A key consideration is what happens when you die. Many annuities allow you to name a beneficiary. The beneficiary can receive remaining payments or a death benefit. This ensures your loved ones are taken care of financially.

Personal Considerations

Think about your family’s needs. If you have dependents, naming a beneficiary is crucial. My friend Sarah chose an annuity with a death benefit for peace of mind. It gave her comfort knowing her children would be financially secure.

Questions To Consider

Are you planning for just yourself, or do you have others to consider? What type of annuity best fits your financial goals? Ask yourself these questions to guide your decisions. Your annuity should align with your overall financial plan.

Understanding annuity basics is vital for effective planning. It’s about securing not just your future, but your loved ones’ future too. Take the time to explore your options. Making informed choices today can provide peace of mind tomorrow.

Death Benefits In Annuities

Annuities often include death benefits ensuring financial support to beneficiaries. Upon the owner’s death, these funds are transferred to designated individuals. This feature provides peace of mind, knowing loved ones will receive financial assistance.

Death benefits in annuities often puzzle many individuals, especially when planning for the future. Understanding what happens to an annuity when you die is crucial for ensuring your loved ones are protected. This aspect of annuities provides a safety net, making them a significant consideration in financial planning.

What Are Death Benefits In Annuities?

Death benefits in annuities refer to the payout your beneficiaries receive if you pass away. This benefit ensures your investment continues to support your loved ones. It can offer peace of mind, knowing that your financial planning extends beyond your lifetime.

Types Of Death Benefits

Annuities offer different types of death benefits. The most common ones include:

– Lump-Sum Payment: Your beneficiaries receive the remaining value of the annuity in a single payment.

– Installment Payments: Payouts are made over time, providing regular income to your beneficiaries.

– Guaranteed Period Annuity: Payments continue for a specified period, even if you pass away during that time.

Each option has its pros and cons. Consider what aligns best with your family’s needs.

How To Choose The Right Death Benefit

Selecting the right death benefit depends on your financial goals and your family’s future needs. Ask yourself what type of support your loved ones would need most. Would a lump sum help cover immediate expenses, or is a steady income more beneficial?

Discuss your options with a financial advisor. They can help tailor a plan that fits your unique situation.

Real-life Scenario: A Personal Story

Imagine a friend who didn’t consider death benefits when purchasing an annuity. Upon his unexpected passing, his family faced financial challenges. This scenario underscores the importance of planning these details.

By considering death benefits, you ensure your family’s financial security. It’s a thoughtful step that can make a significant difference during difficult times.

Why It Matters To You

Planning for death benefits in annuities isn’t just about money. It’s about providing peace of mind and security for those you care about. Reflect on your legacy and how you want to support your loved ones even after you’re gone.

What steps will you take to ensure your family’s future?

Options For Beneficiaries

Understanding what happens to an annuity when you die is crucial, not just for you but for your beneficiaries. When you plan for the future, you want to make sure your loved ones are taken care of. Annuities come with various options for beneficiaries, ensuring that your financial intentions are honored even after you’re gone. Let’s dive into what choices your beneficiaries have.

With annuities, you can tailor your legacy. Beneficiaries usually have several options regarding how they receive the annuity benefits. You can choose a lump-sum payment, allowing them immediate access to funds. This option can be beneficial if your beneficiary needs to cover immediate expenses like funeral costs or debts.

Alternatively, beneficiaries might opt for regular payments over a specified period. This choice provides ongoing support, which can be useful for individuals who need steady income. It mirrors the annuity’s original purpose of providing financial stability.

Choosing Between Lump Sum And Regular Payments

Deciding between a lump sum and regular payments can be challenging. Consider what would best serve your beneficiary’s needs. Does your beneficiary prefer financial independence or need structured support? Reflect on their current financial situation. It’s a decision that could significantly impact their life.

Impact On Taxes

It’s essential to think about tax implications. A lump-sum payment might push your beneficiary into a higher tax bracket. Regular payments could minimize this impact, spreading the taxable income over years. Discussing these options with a financial advisor can help your beneficiary make a tax-smart decision.

Personal Experience: Planning Ahead

When my grandfather passed away, he left behind an annuity with options for beneficiaries. His thoughtful planning allowed my family to choose between immediate funds and ongoing payments. We opted for regular payments, which helped cover my sister’s college tuition. This experience taught us the importance of considering future needs and financial security.

What’s your plan for your annuity? Have you discussed these options with your beneficiaries? It’s never too early to ensure their future is as secure as yours.

Credit: www.bankrate.com

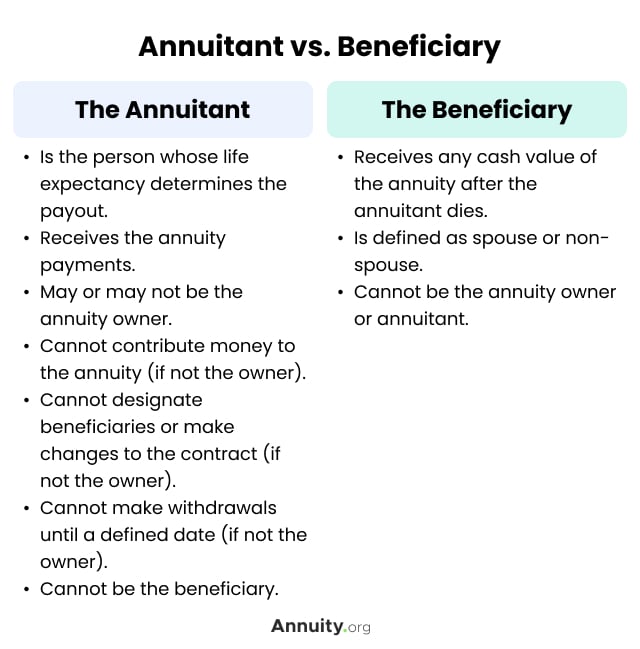

Credit: www.annuity.org

Frequently Asked Questions

Who Gets Annuity Money When You Die?

The beneficiary named in your annuity contract receives the funds upon your death. You can choose one or multiple beneficiaries. If no beneficiary is designated, the annuity may go to your estate. Always review your annuity policy for specific terms regarding death benefits.

What Are The Disadvantages Of An Annuity?

Annuities often have high fees, limiting potential returns. Limited liquidity restricts access to funds. Inflation may erode purchasing power over time. Early withdrawal penalties can be costly. Complexity and lack of transparency may confuse investors.

Can An Annuity Be Inherited?

Annuities can be inherited based on the contract terms. Beneficiaries may receive payments or a lump sum. Tax implications vary, so consult a financial advisor for detailed guidance. Ensure beneficiary information is updated to streamline the inheritance process.

Do Beneficiaries Pay Taxes On Annuities?

Beneficiaries often pay taxes on annuities. Taxes apply to earnings, not the principal. The income is taxed as ordinary income. Beneficiaries should consult a tax professional for personalized advice.

Conclusion

Annuities offer security even after death. Beneficiaries receive payments or a lump sum. Details depend on contract terms. It’s wise to review your annuity plan. Ensure beneficiaries understand their benefits. Consult an advisor for clarity. This helps them make informed choices.

Annuities can provide financial peace. Planning keeps loved ones secure. Choose wisely for your family’s future. Make decisions that align with your goals. Consider all options carefully. This ensures the best outcome. Protecting loved ones is key. Annuities can be a valuable tool.

Secure a stable financial future today.